1

Immense growth potential with healthy return ratios

Please refer to important disclosures at the end of this report

1

1

SBI Cards & Payment Services Limited (SBI Cards), a subsidiary of Sate Bank of

India (SBI), is a non-deposit taking NBFC and one among the two credit card

issuers registered as an NBFC and will become the only listed company in India in

this space. SBI Cards is the 2nd largest credit card issuer in India, with 18.1%

market share in terms of the number of credit cards outstanding as of November

30, 2019. SBI Cards offers various types of credit cards considering the need of

retail clients (viz. Lifestyle Cards, Rewards, Shopping, Travel and Fuel). It also

offers corporate cards and is the largest co-brand credit card issuer in India. It

also issue card in partnership with smaller or regional banks.

Immense growth potential given low penetration and large untapped SBI

customers: SBI Cards has grown its outstanding cards at healthy CAGR of 28%

over FY2015-19 while the industry grew at 23% over the same time. Furthermore,

we expect SBI Cards to continue to register healthy CAGR over FY2020-24 owing

to (a) Significantly underpenetrated Indian credit card market; number of credit

cards per 100 people is 3, whereas in developed/developing countries it is >30.

(b) As on Q3FY2020, credit card to debit card ratio was 3.7% for SBI Cards (vs.

peers viz. HDFC Bank – 45%, Axis Bank – 28% and ICICI Bank – 18%), which

clearly indicates huge scope for mining SBI Bank customers. (c) Total credit card

outstanding loan as % of banking sector loan is just 1.22%, and retail loan is

27%, indicating enough space to increase credit card loan book. (d) Credit card

spend as % of GDP for India is 3%, while that for other countries is >10%. All the

above factors clearly show that there is a huge room for credit card industry to

grow. We believe, with strong parentage and healthy capital adequacy, SBI Cards

should be able to growth at healthy CAGR and gain market share.

Healthy return ratios; stable asset quality despite strong advances growth: SBI

Cards has reported average ROE/ROA of 29%/4.3% over last 3 years. C/I has

declined from 63% in FY2017 to 60.5% in FY2019 and further reduced to 56.6%

for 9MFY2020. Spend base fees contributes 26% of total income and increase in

card spending will improve spend base fees, which will increase operating

leverage, aiding further reduction in C/I. Advances grew at CAGR of 34% over

FY2017-19, however asset quality remained stable in the range of 2.3–2.4%.

Outlook & Valuation: At the upper end of the price band, SBI Cards is valued at

45.5x of 9MFY2020 annualised earnings. Although the valuations are a bit on

the higher side, we are positive on the future outlook of the company given

favorable industry scenario, large untapped SBI Bank customers and strong

financial track record. We recommend a Subscribe to the issue.

Key Financials

Y/E March (` cr)

FY17

FY18

FY19

9MFY20

NII

1,360

2,048

2,559

2,527

YoY Growth (%)

51

25

PAT

373

601

863

1,161

YoY Growth (%)

61

44

EPS

4

6

9

17

Book Value

16

25

38

51

P/E

189

117

82

45

P/BV

49

30

20

15

ROE (%)

26

32

29

38

Source: Company, RHP, Angel Research; Note: Valuation ratios based at upper end of the price

band. 9MFY2020 EPS is annualised.

SUBSCRIBE

Issue Open: March 02, 2020

Issue Close: March 05, 2020

Offer for sale: `9,855cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 69.5%

Others 30.5%

Fresh issue: `500cr

Issu e Details

Face Value: `10

Present Eq. Paid up Capital: ` 932.3cr

Post Issue Sh areh oldin g Pattern

Post Eq. Paid up Capital: `939cr

Issue size (amount): *`10,290cr -

**10,355 cr

Price Band: `750-755

Lot Size: 19 shares and in multiple

thereafter

Post-issue implied mkt. cap:

*`70,422cr - **`70,891cr

Promoters holding Pre-Issue: 74%

Promoters holding Post-Issue: 69.51%

*Calculated on lower price band

** Calculated on upper price band

Book B u ilding

SBI CARDS AND PAYMENT SERVICES LIMITED

IPO Note | BFSI

Feb 27, 2020

2

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

2

Comp Background:

SBI Cards is the credit card marketing and issuing arm of India’s largest bank, SBI.

The company was established in 1998 and since then it is offering various credit

card services matching the needs of different economic classes of the country. It

was incorporated as a joint venture between State Bank of India and GE Capital

Mauritius Overseas Investment. On December 15, 2017, GE Capital Mauritius

Overseas Investments sold its entire stake (40%) in the company to State Bank of

India (14%) and CA Rover Holdings (26%).

CA Rover Holdings: CA Rover Holdings, an affiliate of the Carlyle Group, currently

owns 26% of the total outstanding equity share capital. Carlyle Group is a global

investment firm having deep industry expertise with over $222 billion of assets

under management as of March 31, 2019.

SBI Cards is the 2nd largest credit card issuer in India, with a 17.6% and 18.1%

market share of the Indian credit card market in terms of the number of credit

cards outstanding as of March 31, 2019 and November 30, 2019, respectively,

and a 17.1% and 17.9% market share of the Indian credit card market in terms of

total credit card spends in fiscal 2019 and in the 8 months ended November 30,

2019, respectively, according to RBI.

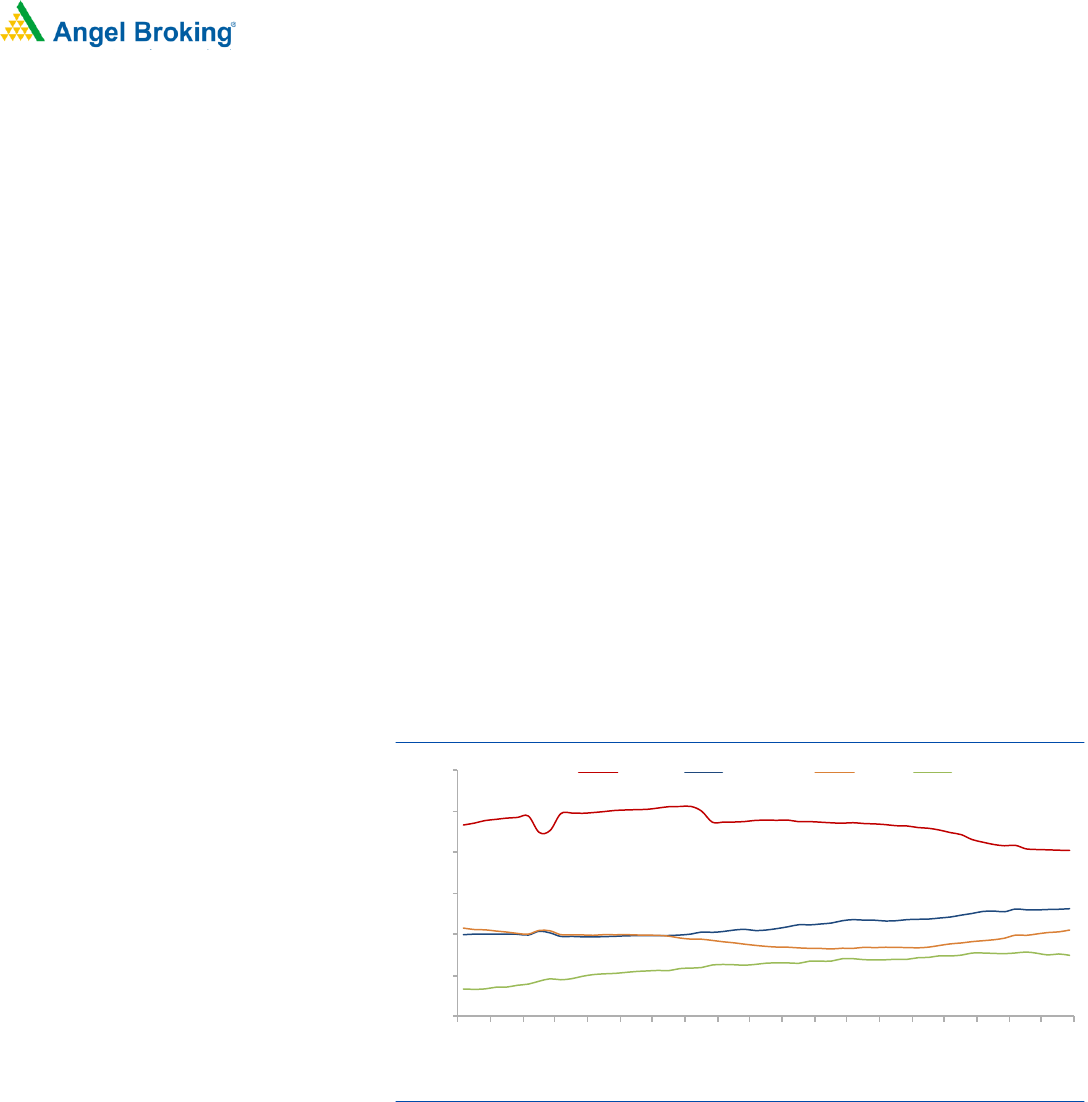

Exhibit 1: % of Cards in Force

Source: Company, RBI

How does SBI Cards earn revenue and other income?

The revenue that SBI Cards derives from its credit card products consists primarily

of interest on its credit card receivables and non-interest income primarily

comprising of fee-based income such as interchange fees (i.e. fees received from

credit card payment networks such as MasterCard, Visa and RuPay), late fees,

annual credit card membership fees and other fees.

A typical credit card transaction begins when a cardholder purchases goods or

services from a merchant using its credit card. After the transaction is authorized by

the credit card issuer through the payment network, the credit card issuer pays the

purchase amount to the payment network net of interchange fees. The payment

28.3%

25.2%

15.0%

18.1%

15.7%

15.5%

8.3%

12.4%

5%

10%

15%

20%

25%

30%

35%

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

Jul-16

Oct-16

Jan-17

Apr-17

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Jul-19

Oct-19

HDFC

SBI Cards

ICICI

AXIS

3

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

3

network, in turn, then pays the purchase amount to the acquirer. Finally, the

acquirer pays the purchase amount to the merchant net of acquirer fees.

SBI Cards earns interest income on “revolver” receivables, “transactor” receivables

and “term loan” receivables. Revolver receivables are characterized by balances,

which are carried over from one month to the next and, consequently, accrue

interest charges. Transactor receivables are characterized by balances, which are

paid in full every month by the due date and, consequently, do not accrue any

interest charges. Term loan receivables are comprised of equated monthly

installment balances.

Other income comprises of income from fees and services, services charges,

business development incentive income, insurance commission income.

Income from fees and services: Income from fees and services primarily relates to

the various types of credit card fees and charges that it generates from its

operations.

Subscription-based fees: Subscription-based fees primarily consist of credit

card membership fees and annual credit card fees that it charges its

cardholders.

Spend-based income: Spend-based income primarily consists of the

interchange fees that it earns as consideration for the transactions carried out

by its cardholders using its credit cards.

Instance-based fees: Instance-based fees primarily consists of a wide range of

fees that it charges its cardholders, including late fees, reward redemption

fees, cash withdrawal fees, over-limit fees, payment dishonor fees, processing

and statement retrieval charges, among others.

Service charges: Service charges primarily comprise of commission from selling of

third party products (like card protection plans).

Insurance commission income: Insurance commission income is comprised of

commissions or incentives that it earns as a corporate insurance agent in selling its

partners’ insurance products to its cardholders.

Exhibit 2: Revenue from operations mix – FY19

Particular

%

Net Interest Income

40.8

Other Income

10.2

Other Income-Misc

4.6

Service .Charges

2.0

Business development incentive income

3.5

Insurance commission income

0.1

Net gain on fair value changes

0.0

Income from fees and services

49.0

Subscription-based fees

6.9

Spends-based fees

26.2

Instance-based fees

15.8

Source: RHP

4

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

4

Exhibit 3: Income from fees and services mix – FY19

Particular

%

Income from fees and services

100

Subscription-based fees

14.8

Spends-based fees

51.0

Instance-based fees

34.2

Source: RHP

Key Management Personnel:

Mr. Hardayal Prasad is the Managing Director and CEO of SBI Cards and

Payment Services. He holds a Masters degree in Chemistry from Agra College and

is a certified associate of Indian Institute of Bankers. He has handled several

assignments for SBI in various locations in India and abroad. He has been a part

of SBI since 1983 and has 36 years of experience in the banking industry.

Mr. Richhpal Singh, COO of the company, is a bachelor in arts from Maharshi

Dayanand University, Rohtak. He was associated with the erstwhile SBIBPMSL

(previously known as GE Capital Business Process Management Services Private

Limited) since December, 2017. Previously, he was associated with Jio Payments

Bank Limited and SBI.

Ms. Aparna Kuppuswamy, Chief Risk Officer of the company is a Masters in

Finance and Control from the University of Delhi. She was associated with GE

Money Financial Services for one year and was then transferred to SBI Cards in

April, 2009. Previously, she was associated with American Express Financial

Advisors, Bank of America and ABN AMRO Bank.

Mr. Girish Budhiraja is the Chief Product and Marketing Officer. He holds a

Bachelor’s degree in Technology in Mining Engineering from Indian School of

Mines and a post-graduate diploma in management from IIM, Bangalore. He is

working with SBI since November, 2012. Previously, he was associated with

American Express Bank Limited, and ICI India Limited.

5

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

5

Issue details

SBI Cards IPO is raising `500cr (0.66cr shares) through fresh issue and `9,855cr

(13.05cr shares) through offer for sale (OFS). The Promoter, State Bank of India

(SBI) and CA Rover Holding are collectively selling 13.05cr shares through OFS.

Post Issue, SBI’s stake will decline from 74% to 69.5% and CA Rover’s stake will

decline from 26% to 16%. AT upper price band of IPO, SBI and CA Rover Holding

will garner `2,816cr and `7,039cr, respectively.

In this IPO, there is reservation kept for employee of SBI Cards and SBI, along with

this they will also get `75/- discount. Total 1.49cr share are reserved for

employees and shareholders, of this 0.19cr for employee and remaining 1.31cr

share for shareholder of SBI Cards and SBI.

Exhibit 4: Pre and post IPO shareholding pattern

Particular

No of shares

(Pre-issue)

%

No of shares

(Post-issue)

%

Promoter

68,99,27,363

74.0

65,26,33,992

69.51

Investor/Public

24,24,06,915

26.0

28,63,22,803

30.49

Total

93,23,34,278

100.0

93,89,56,795

100.00

Source: RHP Note : Calculated on upper price band

Objects of the offer

The net proceeds of the Fresh Issue are proposed to be utilized for

augmenting capital base and general corporate purposes.

To achieve the benefits of listing the Equity Shares on the Exchanges and to

carry out offer for sale of equity shares.

Risk

Any changes by Indian regulator (RBI) on interchanges fees (spend based fess)

would impact SBI Cards’ financials and return ratio. As interchanges

contribute 44% of other income and 26% of total income.

Presently, RBI does not allow NBFCs to offer their own credit cards. If in

foreseeable future, RBI allows NBFCs to issue credit cards, it will pose the risk

of competition for SBI Cards.

Prolonged slowdown in economy would impact asset quality adversely,

consequently provision costs would go up.

6

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

6

Income Statement

Y/E March (` cr)

FY17

FY18

FY19

9MFY20

NII

1,360

2,048

2,559

2,527

- YoY Growth (%)

51

25

Other Income

1,583

2,610

3,711

3,747

- YoY Growth (%)

65

42

Operating Income

2,943

4,659

6,270

6,274

- YoY Growth (%)

58

35

Operating Expenses

1,839

2,939

3,790

3,553

- YoY Growth (%)

60

29

Pre - Provision Profit

1,104

1,719

2,479

2,721

- YoY Growth (%)

56

44

Prov. & Cont.

532

800

1,148

1,102

- YoY Growth (%)

50

43

Profit Before Tax

572

919

1,332

1,619

- YoY Growth (%)

61

45

Prov. for Taxation

199

318

469

457

- as a % of PBT

35

35

35

28

PAT

373

601

863

1,161

- YoY Growth (%)

61

44

35

Balance Sheet

Y/E March (` cr)

FY17

FY18

FY19

9MFY20

Share Capital

785

785

837.2

932.3

Reserve & Surplus

664

1,568

2,745

3,819

Net Worth

1,449

2,353

3,582

4,751

Total Borrowings

8,557

12,061

14,718

19,421

- Growth (%)

41

22

Other Liabilities

759

1,272

1,940

1,821

Total Liabilities

10,765

15,686

20,240

25,993

Cash and Cash equivalents

175

312

734

453

Investments

111

275

75

86

Total Loans & Advances

9,983

14,046

17,909

23,933

- Growth (%)

41

28

Fixed Assets

2

121

142

164

Other Assets

495

933

1,380

1,358

Total Assets

10,765

15,686

20,240

25,993

- Growth (%)

46

29

7

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

7

Key Ratio

Y/E March

FY17

FY18

FY19

9MFY20

Profitability ratios (%)

NIMs

13.5

16.8

15.8

-

RoA

3.5

4.5

4.8

6.9

RoE

25.7

31.6

29.1

37.9

C/I

62.5

63.1

60.5

56.6

Capital adequacy ratios (CAR)

Tier I CAR

11.3

12.4

14.7

15.4

Tier II CAR

4.4

5.9

5.3

3.8

Total CAR

15.7

18.3

20.0

19.2

Asset Quality (%)

Stage 1 & Stage 2 (` cr)

10,064

14,157

18,073

24,164

Stage 3 (` cr)

241

412

453

612

Provision

Stage 1 & Stage 2 (` cr)

159

247

316

433

Stage 3 (` cr)

164

278

301

410

Provision %

Stage 1 & Stage 2

1.58

1.74

1.75

1.79

Stage 3

67.9

67.3

66.5

67.0

Gross NPAs %

2.3

2.8

2.4

2.5

Net NPAs %

0.8

1.0

0.8

0.8

Credit Cost

5.3

5.7

6.4

6.1

Per Share Data (`)

EPS

4.0

6.4

9.3

16.6

BVPS

15.5

25.2

38.4

51.0

Valuation Ratios

PER (x)

188.8

117.1

81.6

45.5

P/BVPS (x)

48.6

29.9

19.7

14.8

DuPont Analysis

FY17

FY18

FY19

9MFY20

Interest Income

17.5

20.9

19.9

20.7

Interest Expenses

4.9

5.4

5.7

5.7

NII

12.6

15.5

14.2

14.9

Provision

4.9

6.0

6.4

6.5

Adj NII

7.7

9.4

7.9

8.4

Other Inc.

14.7

19.7

20.7

22.2

Total Income

22.4

29.2

28.5

30.6

Opex

17.1

22.2

21.1

21.0

PBT

5.3

7.0

7.4

9.6

Taxes

1.8

2.4

2.6

2.7

RoA

3.5

4.5

4.8

6.9

Leverage

7.4

7.0

6.1

5.5

RoE

25.7

31.6

29.1

37.9

Valuation done at upper price band, 9MFY20 valuation done on annualized number.

8

Feb

27,

SBI Cards and Payment Services Limited | IPO Note

Feb 27, 2020

8

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information..